If you are trapped in debt, you need an effective repayment strategy to free up your finances. The debt avalanche method has proven to be one of the best methods anyone can use to pay down debt successfully. Paying different debts at the same time can indeed be overwhelming. That’s why you must employ a technique that makes your repayments feasible and less stressful.

The debt avalanche method mainly involves paying off your highest-interest debt before clearing up other debts. This strategy can help you avoid hefty interest charges and stay out of debt for good.

Using a practical example, this post will help you understand how to pay all your debts systematically using the avalanche technique.

What Is A Debt Avalanche?

The debt avalanche is a standardized method for paying down debts without getting overwhelmed by interest rates. If you stick with this method, you can pay your debt faster and avoid spending extra money on high-interest rates on your larger debts.

How The Debt Avalanche Method Works?

Using the avalanche method for paying debt means you have to focus on clearing your highest-interest debt before any other debt on your list.

For instance, if your highest-interest rate debt is a credit card balance carrying a 20% interest rate per year, you must make it your primary goal. Mind you, this doesn’t mean you would forget about your other debts. You will keep paying other debts, but whenever you realize some extra money, you put it toward your highest-interest rate debt. Once this particular “huge” debt is paid off, you can move to the next high-interest rate.

It’s like a slope, sliding rapidly from the top until you get to the bottom. Apparently, that’s how an avalanche occurs: the large body of snow slides down a mountainside. Hence, in this context, avalanche refers to your highest-interest rate crashing down quickly just as snow and ice do in a “natural avalanche” that occurs on a mountainside.

By adhering strictly to this strategy without missing any of your repayments, you won’t just only erase all the debts, but you will also lessen the total interest charges you are expected to pay. Student loans, credit cards, auto loans, medical bills, and personal loans are perfect examples of debts to include in a Debt Avalanche.

How Do You Use The Debt Avalanche Method?

You don’t need professional assistance to use the debt avalanche method. You can easily carry out this technique independently without consulting a financial adviser. Here are the basic steps to pay off debt using the avalanche method:

Step 1: List Your Debt From Highest Interest Rate To Lowest

At this point, you should probably understand why you need to do this. Ranking your debt from the highest interest rate to the lowest will help you set your priorities straight. It’s important you clear the large debts with the highest interest rate to prevent your late payment fees from piling up.

When you pay off your debts according to this ranking, you are actually preventing future expenses by reducing your charges on interest rates.

Step 2: Create A Budget

Budgeting is key when using the avalanche method of paying debt. You need to track your income and expenses to determine if you have any extra cash after making your monthly debt payments.

Building a budget also helps you to curb your spending. The moment you decide to start paying off debt, you have to be quite cautious about how you spend your money. In fact, you have to deliberately reduce your spending in order to get extra cash to increase your monthly debt payments.

If it’s your first time building a budget and you need help to get started, here’s a simple step-by-step guide for how to create a budget.

Step 3: Make More Payments On Debts With The Highest Interest Rate

This is the stage where you have to review your budget to see how much money you contribute monthly to pay off your debts.

Usually, the debt avalanche method is effective when you focus more on the debt with the highest-interest rate. In most cases, credit card debt falls in this category. Paying down the balance as soon as possible will save you money on the interest rate which increases if you miss your monthly payments.

Step 4: Increase Your Extra Payments

From the start, you might feel like you aren’t making enough progress with the debt avalanche method. This happens when your debt with the highest interest rate also has a high balance. Notwithstanding, you don’t have to be discouraged. By the time you finish paying off your first debt, contribute that extra money monthly toward the next debt on your list.

As you finish paying each debt, the extra monthly payments will build up. This will speed up the process, helping you pay off your debts on time.

An Example Of The Debt Avalanche

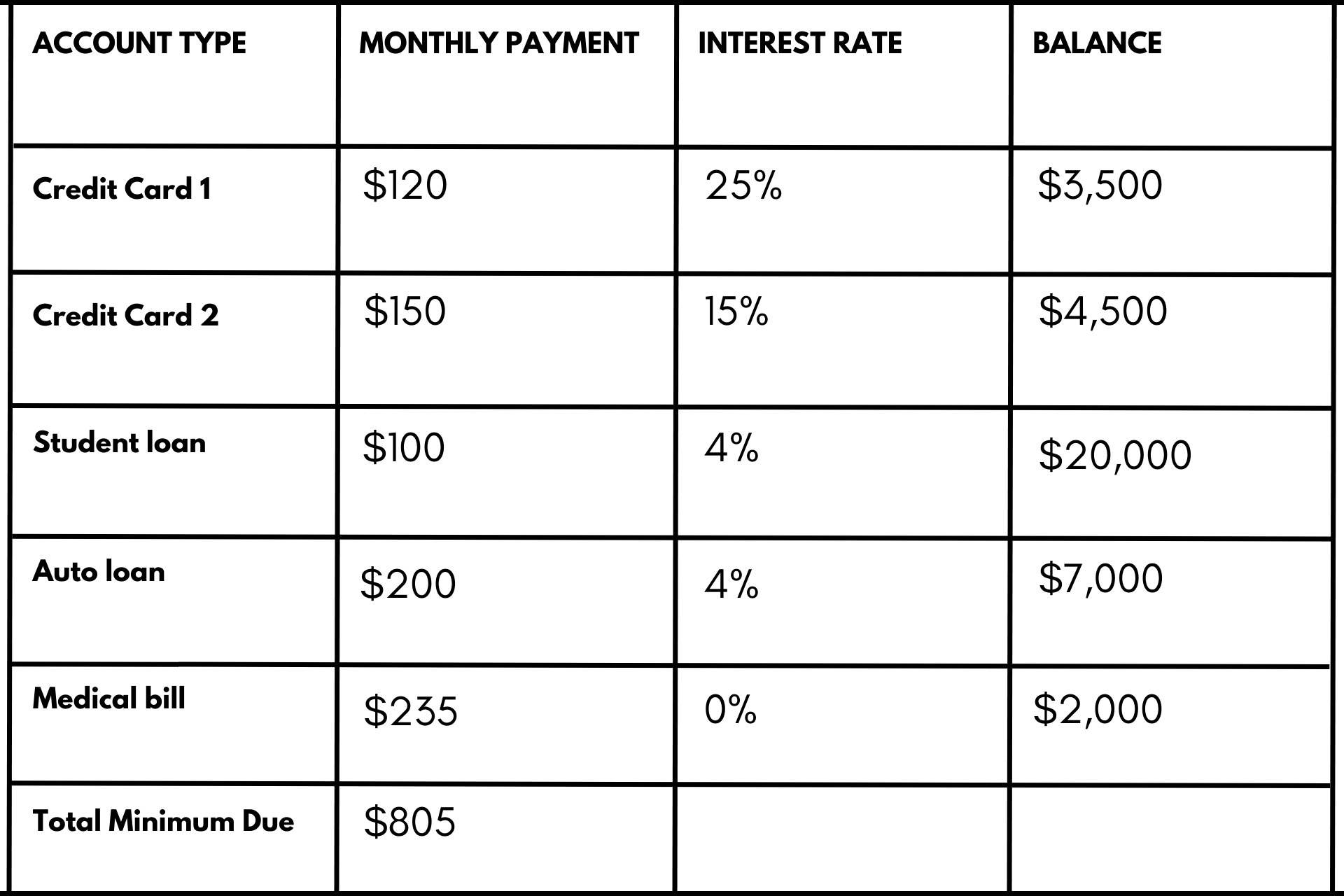

Don’t bother wondering what the debt avalanche method looks like. Here’s a simple example of how the strategy is being used to calculate and pay off multiple debts:

Looking at this debt avalanche example above, you can see that the first credit card has the highest interest rate. It’s certainly not the largest debt, but the number one rule of the debt avalanche strategy requires that you pay it off first.

While making your monthly payments, any extra money you get should be put toward paying off your highest-interest rate debt. As soon as you finish paying off the first credit card balance, you can direct that same energy to the second credit card balance. When you pay off the second credit card debt, you can focus on your student loan.

Remember that for every debt you finish paying, you have more money in your checking account to pay off the remaining debts faster.

For example, if you finish paying off the first credit card debt, it means you have an extra $120 every month that could be contributed to pay off another balance. As long as you pay on time and avoid late payment fees, you can pull this off.

The Pros And Cons Of Using The Debt Avalanche Method

The debt avalanche method for paying off debt isn’t perfect for everybody. Before using the strategy, you have to assess some of the factors that make it a good idea and other factors that might not make the strategy a favourable option for you.

Here are the advantages and disadvantages of a Debt Avalanche:

[Pros]

- Pay Your Highest-Interest Debt Early

One of the main benefits of using this method is that you have the opportunity to clear up your highest-interest rate before any other debt. This could prevent you from spending a considerable amount of money on interest charges in the future. Technically, it saves you money.

One common mistake people make when paying off debt is not paying attention to interest rates. The debt avalanche method enables you to see how important it is to tackle your high-interest rates instead of just paying off your debts randomly.

- It Motivates You

Getting rid of your debt with the highest-interest rate might be the biggest motivation you need to pay off your entire debt. Seeing how you are able to pay off the first debt successfully, you will continually see the possibility of paying off the remaining debts on your list. It motivates you to remain consistent with your monthly payments.

[Cons]

- Takes Time

If the highest-interest rate debt has the highest balance, paying it off won’t be easy. It would take a while for you to see progress. This might make it difficult for you to stick to the strategy since you could be discouraged in the process.

- Expensive

Using a high rate method for paying off debt just like the avalanche strategy means you must have a reliable income stream. Remember, you are making monthly payments and you can’t afford to miss any of them. Hence, you need a steady cash flow with enough money to fund your monthly bills and service your debts.

If your paycheck is becoming too small, consider finding a side business or working multiple jobs. Once you finish clearing all your debts, you can choose not to work that hard anymore.

Who Is The Debt Avalanche Method For?

The debt avalanche method is meant for you if you want to pay off your high-interest debt first. However, this method can only work when you have the self-discipline and self-motivation to remain consistent with your monthly payments.

You must also be patient since it would take time to repay all the debts. Of course, the end justifies the means. But if you aren’t willing to trust the process, you probably won’t reach the end.

Other Methods For Reducing Debt

The debt avalanche method is commonly used to pay off debt, but there are other strategies you can rely on. Besides, it might not be the perfect strategy for you. Here are other options you might want to consider:

Debt Consolidation

Consolidating your debt can be a good option when you have various debts you are struggling to pay off. This method requires you to use a personal loan to settle all outstanding debts. Once you do this, it means you no longer have different types of debts scattered everywhere. Instead, you now have one big debt that you can gradually pay off with a relatively low-interest rate.

You won’t have to worry anymore about managing multiple debts and several due dates. Debt consolidation is recommended only if you get an interest rate lower than what you were previously paying. Otherwise, consider using another debt repayment strategy.

Debt Snowflake

This is not a structured debt repayment strategy like the avalanche method or the debt snowball method. It has a straightforward approach: grouping small amounts of cash and contributing the total sum toward paying off your debts.

For example, if you find a $5 bill in your closet and have already saved $3 on a discounted product, you obviously have $8 you can direct toward debt reduction. However, this would take a longer time to pay your debts. You shouldn’t rely on it if you have huge balances to clear up.

Balance Transfer

This is similar to debt consolidation. It involves moving your unpaid debt from one or more accounts to a new credit card. Usually, this is done to get a lower interest rate, enabling you to pay off your debt on time.

But before transferring your balance, carefully review all the required terms and conditions. You may have to pay a certain fee to transfer your balance. Besides, you need to ensure that moving your balance won’t affect your credit score.

Monitor Your Credit

Your credit is a very important factor to consider when using debt reduction options. When you monitor your credit reports and scores, you can decide if it’s a wise decision to refinance your debt or whether you are eligible for a credit card with a 0% APR. Even so, getting credit cards with an introductory 0% APR is possible. You only need to meet the requirements.

Final Words On The Debt Avalanche Method

Regardless of the debt repayment strategy you choose, make sure it fits your financial situation. You shouldn’t use the debt snowflake method when you have several debts with large balances. That would be a waste of time. Use a strategy that keeps your debt situation under control and enables you to pay off everything you owe on time. Always compare your options before deciding on the debt reduction method you want.

Nevertheless, the option predominantly discussed in this post is one of the best-known methods out there. Using the debt avalanche tips from the example given, you can pay off your debts simultaneously while focusing on the highest interest rates.

Pin this for later!