Getting out of debt all by yourself can be very challenging. Firstly, you probably lack insight into how you are supposed to pay off your debt. You don’t even know the ideal debt payoff method that suits your financial situation. This is why some of the best debt payoff apps have been developed by certain companies to help you combat the common challenges faced when trying to pay off debt.

I’ve never really had to use a debt payoff app. Perhaps it’s because I’ve always tried to avoid being in serious debt. However, I’ve counseled several families on how to pay off debt, and one of the strategies I recommend is using a functional debt payoff app.

In this post, I will be discussing the best debt payoff apps that you need to become debt-free faster and easier. You don’t have to rack your brain anymore about debt issues. These apps are real problem solvers when it comes to paying off debt.

How Do Debt Payoff Apps Work?

Debt payoff apps work by helping you to automate your debt payment procedure. You can easily create different loan categories and automate the monthly payments. More importantly, some of these apps offer you the option to choose payoff options such as the debt snowball or the debt avalanche method.

What Is The Best Debt Payoff App Out There?

There are dozens of amazing apps to help you pay off debt. Some of them are free to use, while some offer premium plans that require monthly subscriptions. Notwithstanding, Qapital and Digit are among the very best options out there.

How To Pick The Best Debt Payoff App For You

To pick the best debt pay-off app, you have to first keep in mind the things you need help with. For example, if you are finding it difficult to pay more than the bare minimum every month, then you need a debt payoff app that allows you to save money automatically.

If you are struggling to reduce your spending and manage all your accounts, then you should go for an all-purpose money management app like Mint. With this app, it’s easier to set financial goals, examine your financial accounts, and ultimately pay off your debt on time.

Another factor to consider when choosing a debt payoff app is the cost that may be involved. Some of the best options out there are not free. You may have to pay between $3.50 and $10 monthly. If you have no problem paying for the premium service, then go ahead and use the app of your choice.

However, if you need to drastically cut down costs and save money, choose a free option instead. For example, Mint is completely free to use.

15 Best Debt Payoff Apps

The most difficult aspect of paying off debt is trying to figure out the best payoff strategy. But it stops being an issue when you have an efficient debt management tool. Here are the best debt payoff apps to pay your mortgage, student loans, or credit card debts:

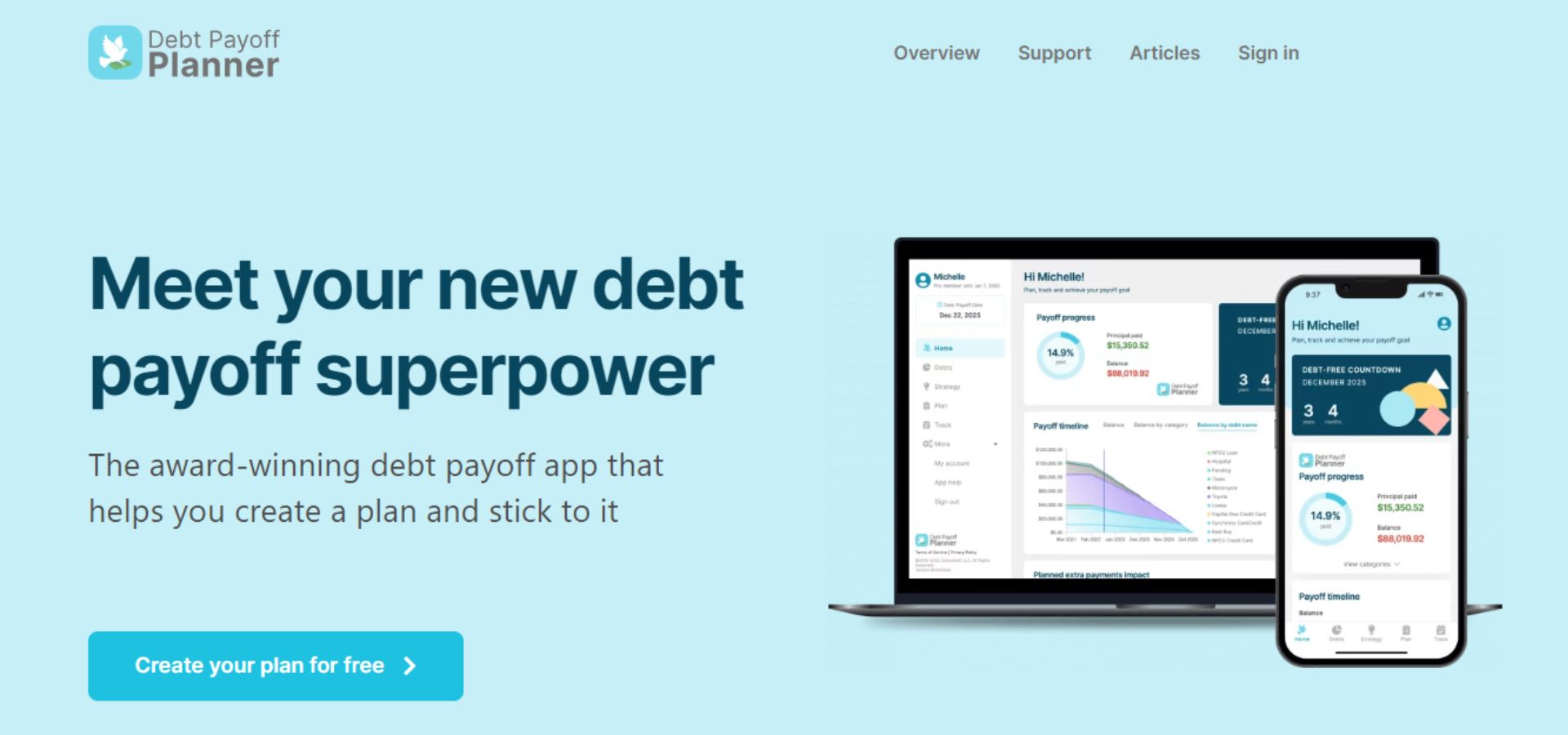

1. Debt Payoff Planner

This app is a special tool that you can use to review your debt situation and have a good look at your finances. You can use it to track your progress, checking how much you have paid and how long it would take to complete the payments. The app is designed to work in four segments: debts, strategy, payoff plan, and tracking.

After deriving information from your debt balances, APRs, and minimum payments, it can now recommend the ideal payoff strategy and plan you need to be debt-free.

As one of the best apps for paying off debt, the Debt Payoff Planner is not completely free. To enjoy all the premium tools and features, you have to pay $6 per month for the pro version.

2. Bright Money

When it comes to debt consolidation, this is one of the best debt management apps to use. Bright Money works by offering a low-interest line of credit that consolidates all your debts. The best part of using this app is that you are eligible for the consolidation plan regardless of your credit score. By using the app’s low-interest line of credit, you can save money over time and pay your debt on time.

Also, Bright Money can help you to automate your debt payments using its MoneyScience Algorithm. These payments would be made based on certain factors such as your income, spending, and impending bills.

This app is not free. It costs $6.99 monthly if you choose the annual plan. But if you decide you want to be billed monthly, you’d have to pay $14.99.

3. Tally

This is another amazing option, and it’s one of the free iOS apps for debt payoff. Tally makes it easy to track your credit card debt. It offers a low-interest line of credit that replaces what you owe.

Apparently, Tally helps you to pay your debt instantly, and then you’d have to pay them back directly. The interest rate begins at 7.9%, and you can’t get more than $25,000 of credit. However, this will help you reduce the number of bills that come with using multiple credit cards.

Also, bear in mind that Tally requires a minimum FICO credit score of 580 to be eligible for its offer.

4. Qapital

If you are looking for an effective tool to automate payments, this is one of the best debt payoff apps for you. However, the app is not free. Depending on the type of account you choose, you will be required to pay between $3 and $12.

With Qapital, you can direct money to your debt balance automatically. All you have to do is set it up and forget about it until your debt is fully paid. By making regular payments with the automated system, you can actually build your credit score over time.

Another cool thing about this app is that it offers a bank account. If you are paying off student loan, you can set up an auto-debit from your Qapital account, helping you save up to 0.25%.

Best Apps To Help Pay Off Debt

5. Trim

This is one special app that helps you attain a debt-free life. Trim works by negotiating credit cards’ APR on your behalf with the issuing bank. If you are paying off multiple high-interest credit cards, you should consider this offer. It’s a huge help. Remember, paying less interest means you could get out of debt faster.

6. Earnin

Earnin is one of the best apps to help pay off debt when you need cash advances.

The app offers you a cash advance without demanding interest or special fees. You can take money from your paycheck before payday to get by during financial stress. The advance limit is $500, and it is the highest on the market. But when using the app for the first time, you can’t get $500. You would start with $100 and build up your record till you are eligible for getting higher amounts of money.

The whole idea of using Earnin is that it can keep you from incurring credit card debt.

7. Simplifi

When trying to pay off debt, tracking your expenses is very important. Simplifi, one of the best Android apps for debt payoff, tracks your expenses using an automated system. It imports and categorizes your transactions from various financial institutions.

Simplifi is connected to more than $14,000 banks. You can virtually link it to your bank accounts, loans, or credit cards. As long as these connections are enabled, the app provides comprehensive and accurate financial information that you need to monitor your expenses.

Also, bear in mind that using this app costs $3.99 – $5.99 monthly.

Best Apps For Paying Off Debt

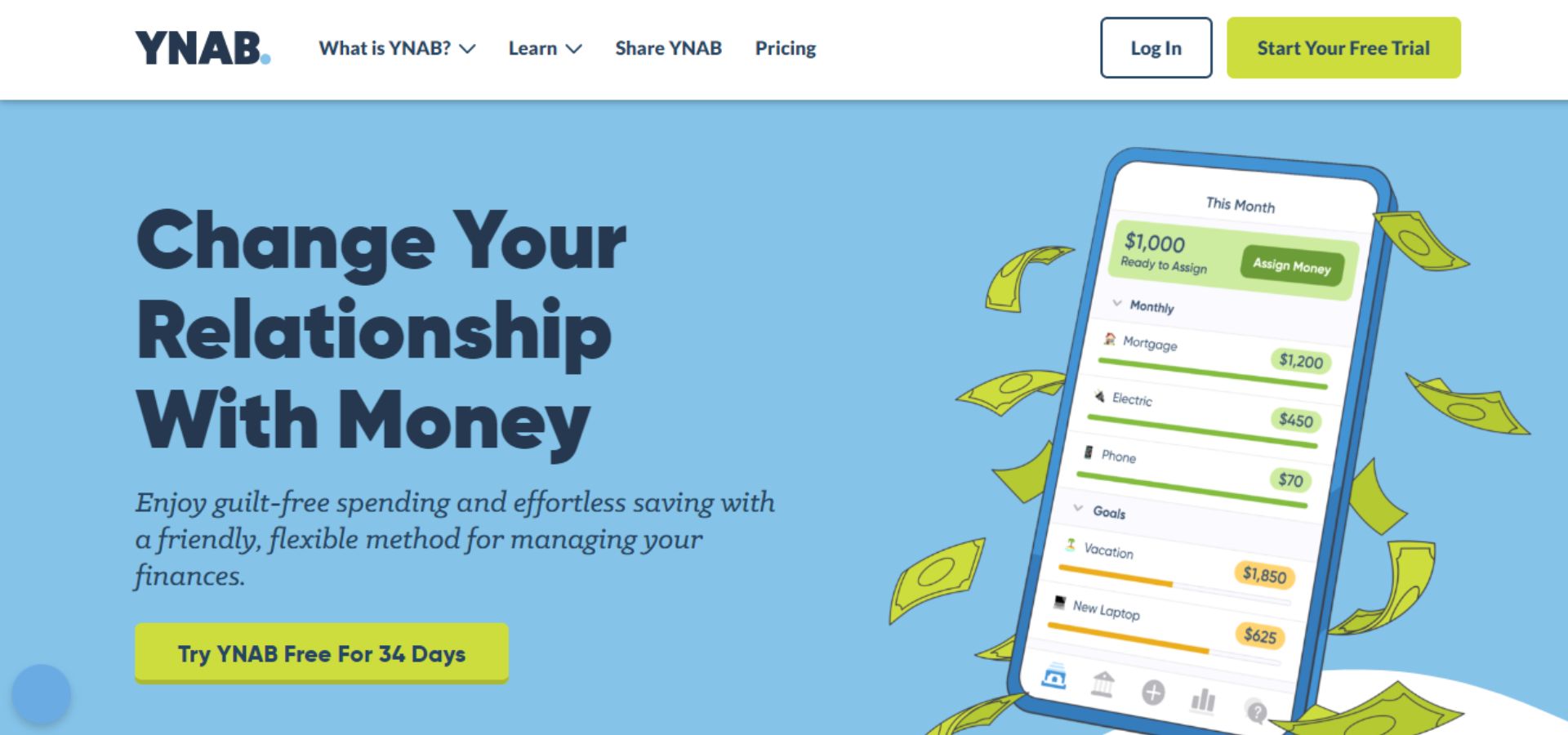

8. YNAB

You Need A Budget (YNAB) is a financial tool popularly known for building a budget. However, the features and tools in it makes it one of the best debt payoff apps.

Firstly, this app curbs your spending by helping you analyze your costs and identify the unnecessary expenses that can be cut off. It does this through budgeting rules and visual reports of your spending.

YNAB also goes further by advising you to give every dollar a job. What this means is that every dollar in your budget is allotted to a particular category in your spending plan. This will help you see where your money goes, giving you control of your financial situation.

9. Credit Karma

When paying off debt, maintaining a good credit score is important. A good credit score makes you eligible for APRs and loans in the future.

Credit Karma debt payoff planner tools help improve your credit score. It works by providing financial reports from TransUnion and Equifax to keep you informed and updated about your credit score. This way, you can easily tell if you are progressing or damaging your credit score.

Credit Karma finds the differences between your TransUnion and Equifax reports to spot any error of fraud that may affect your credit. This app is free to use, and it’s compatible with both Android and iOS devices.

10. Digit

Digit is one of the top debt payoff apps you can rely on.

After connecting the app to your bank account it provides timely reports on your spending habits. It also allows you to create an account where you can save money toward a goal. It’s your choice to decide what the savings goal would be. But since we are talking about paying off debt, then that’s what the savings should be meant for.

By analyzing your financial situation regularly, Digit ensures you are saving the right amount toward your debt.

Debt Management Apps

11. Mint

Do you worry about managing all your financial accounts at once? Mint is one of the free debt payoff apps that allows you to connect all your accounts to one single source (the app). You can easily manage your bank accounts, credit cards, investments, loans, and other financial accounts in Mint. Besides, the app also provides a feature to track your expenses and budget your money in a way that allows you to save money toward paying off debt.

Basically, Mint isn’t just an app to help you pay off your credit cards or loans. The app has several features that can improve your overall financial situation.

12. Debt Book

If you are looking for another tool to improve your debt-payment process, Debt Book is a great option to consider. The app allows you to record various loans and accounts from a simple interface. It provides a current snapshot of your debt and a visual representation of your progress as you make payments every month.

Debt Book is only available on Android for now, and it’s free to use. However, there are some in-app purchases. Some tools and features cost a few dollars to use.

13. Debt Free

Available on only iOS devices for a small fee of $0.99 per month, Debt Free is one of the most popular debt payoff apps in Apple’s financial category.

The app helps you to have an understanding of your debt situation by providing visual reports and loan calculators. You can manage your financial activities on a daily basis and plan potential debt payoff strategies using this tool.

Like most of the best debt tracker apps, you can set payment reminders on Debt Free. This is what helps you avoid late payments.

Best Debt Tracker Apps

14. Debt Tracker Pro

This is one of the best debt payoff apps for Apple users, and it’s only available for $0.99 per month. The app is designed to help you execute the debt snowball method.

Once you enter your credit card and loan information into the app, it analyzes the information to develop the best way for you to proceed with the payment.

The traditional debt snowball method focuses on paying off the debt with the least balance first. But the Debt Tracker Pro offers a slightly different approach by comparing the upsides and downsides to using alternative payoff strategies like ‘highest balance first’ and ‘highest-interest rate first.’

15. Debt Strategy

This is one of the best debt payoff apps because it allows you to choose from different debt payoff strategies. After assessing the available options, you can decide which strategy is best for your situation.

After choosing a payoff method, Debt Strategy can help you laser your focus on your finances. It helps you track your progress and sets reminders to ensure you don’t miss a payment. With its graphic summary tools and simple interface, the application is easy to use on your iPhone or iPad.

Lastly, the app costs only $0.99 per month.

Wrap-Up: Best Debt Payoff Apps

If you ever get devasted because you’re in debt, I have to remind you that millions of Americans are in debt as well. As a matter of fact, according to the Federal Reserve Bank of New York, Americans have $16.51 trillion in debt.

At this point, it’s safe to say that owing debt is not uncommon in the US. However, what you shouldn’t accept is a debt trap that cripples your finances, preventing you from saving money and hitting your financial goals.

Whether it’s a student loan, mortgage, or credit card, this post has listed the best debt payoff apps to help you get out of debt.

Pin this for later!