Finding a budget method that’s best for your money is very important. Usually, some people find it hard to budget their monthly income, especially due to the procedure they are used to. If you want to make budgeting simple and less complicated, then you should try using a zero based budget.

This is one of the commonly used methods for building a monthly budget. Interestingly, individuals aren’t the only ones using this method. Even large organizations and governments use zero-based budgeting methods for financial planning.

Whether it’s your first time building a budget or you simply just want to switch to a new budgeting method, then it’s important you follow this post closely. I will be discussing the simple procedure for how the zero based budget works. Moreover, to ensure that you understand this concept, I will provide a simplified example that you can model to create your own budget.

You should be excited to learn about this. For the next few minutes, you will want to put away anything that could steal your focus, distracting you from this valuable information.

What Is Zero-Based Budgeting?

Zero-based budgeting is when your monthly income minus your monthly expenses equals zero. If you earn $5,000 a month, everything you spend, save or give out should amount to $5,000. Every dollar that comes into your checking account has a purpose. That’s why “zero-based” seem to be the perfect name for this budgeting method.

Who Does The Zero-Based Budgeting Method Work For?

The zero-based budgeting method is for anyone who wants to hold themselves accountable for every expense made during the month. This method is a simple financial plan that shows you exactly how your money is being spent. You don’t have to worry about any missing dollars. You can see everything your income is being spent on.

Why Is A Zero-Based Budget Important?

The Zero based budget is important because it helps you to account for every dollar spent by the end of the month. There was a time I used to spend without being able to track my spending. I was unable to pinpoint all my expenses, and it felt like I was tossing my hard-earned money in the wind. When I learned how to create a zero-based budget, things became pretty different. I clearly understood how I used my income.

But most importantly, this method taught me how to be careful with my spending habits. Rather than spending my money randomly, I now make rational buying decisions.

If you haven’t been using this budget method to organize your expenses, chances are that you are always confused about how your money is spent. It’s possible you always make impulse purchases, splurging money on the wrong things.

Getting used to the zero based budget would transform your money mindset. You will be more intentional about how you manage your finances rather than live through each month without a reasonable financial plan.

How The Zero-Based Budget Method Works – With Examples

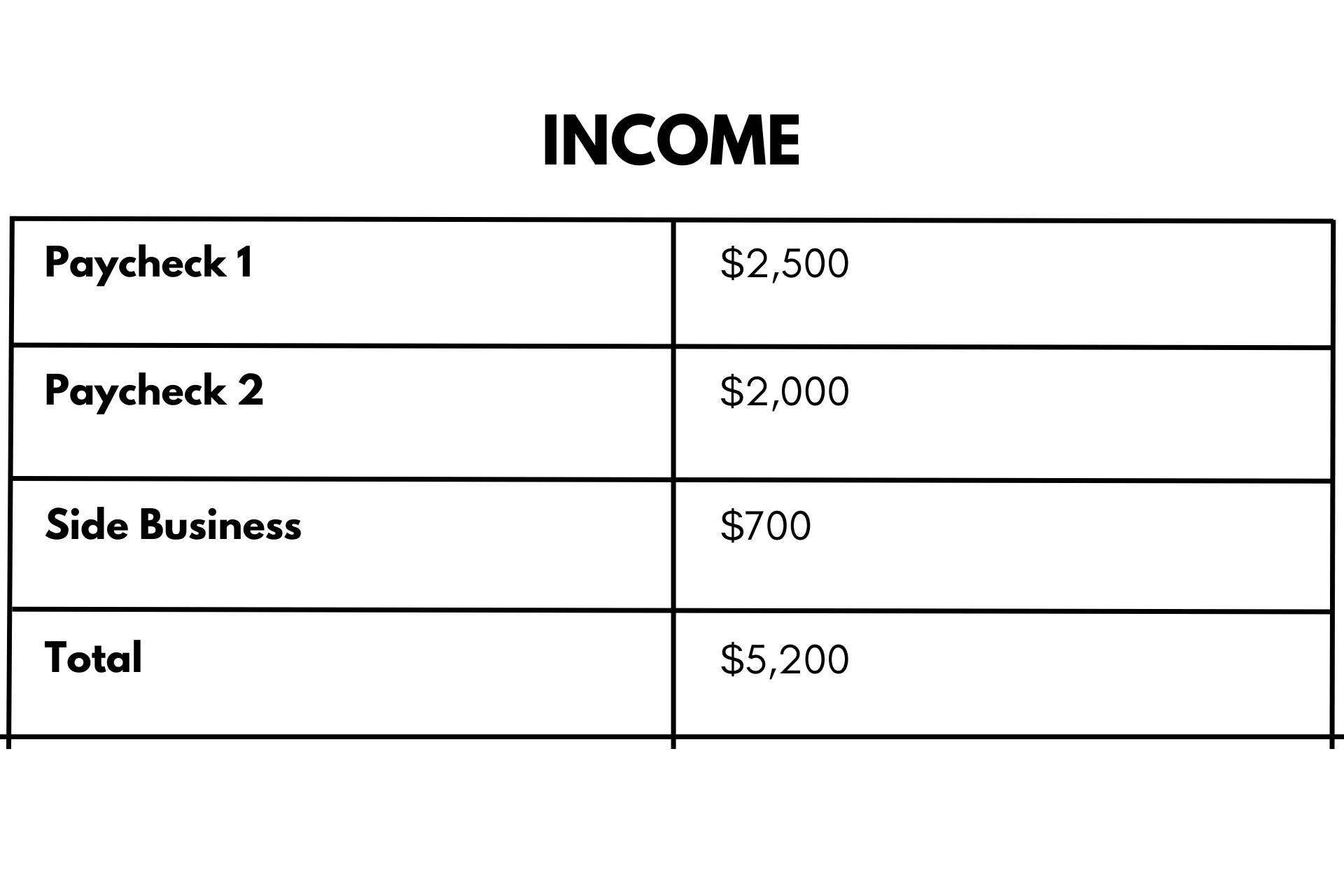

To easily understand how the zero base budget works, here’s a simple example below. This involves basic maths, and you can use it as a guide the next time you want to build a budget.

If total income is $5,200 and total expenses amount to $5,200 as well, then what’s left is zero. That’s why it’s labeled as zero based budget.

Mind you; this doesn’t mean that you’re living paycheck to paycheck. Looking at the example above, you can see there are categories for savings and recreation. So the budget actually allows you to contribute toward your savings goals and also reserve some money in your checking account for entertainment.

This means your bank doesn’t go empty instantly after budgeting your salary.

How To Use The Zero-Based Budget Method

As much as you’ve seen the zero-based budgeting example, you have to be aware of the basic steps involved before you go ahead to create your own budget. Here’s a 5-step process for using the zero-based method to plan for your money:

Step 1: Identify Your Monthly Income Sources

How much money do you make every month, and what are your sources of income? Do you have a single job, or do you work multiple jobs in order to afford all your expenses without relying on credit? You are the only one who can provide answers to these questions. List your monthly income and identify your take-home pay every month.

You can do this the old-fashioned way by writing down your regular paychecks and revenue from your side business (if you have any). The main reason you need to first know your income is to ensure that you don’t incur expenses that are above your means. If your monthly expenses exceed your total monthly income, then the zero based budget can’t work for you.

Step 2: Identify Your Expenses

The next step is to figure out your living costs. List your expenses to see if everything equates to your income at the end of the month. Begin by trying to remember the things you spent money on the previous month.

After listing essential bills like your rent, utilities, transportation, and food, identify your variable expenses like childcare, medical bills, and recreation. Don’t forget to add a miscellaneous category to the list in case anything pops up unexpectedly (things you didn’t budget for).

Step 3: Subtract Your Expenses From Your Income To Equal Zero

This is where you apply the math knowledge you got from elementary school. Subtract all those listed expenses from your income, making sure it equals zero. If you don’t hit zero at first, there is no problem. Leftover cash can always be contributed to your financial goals. If you have a high-yield savings account, just dump it there. Or you can deposit it in your retirement fund.

On the other hand, if you get a negative number after subtracting your expenses from your income, then it means you are spending more than you make. You have to cut down on your living costs to get the number down to zero.

Step 4: Track Your Spending

Setting up a budget is commendable. You have done a great job. But that’s not where it ends. You have to track your transactions and all the purchases you regularly make.

When you pay your rent, tick it off on the housing category in your budget. When you fill your gas tank, subtract it from the transportation category. This is how you stay cautious about your spending and avoid a situation whereby you break your budget.

Step 5: Make A New Budget (As The Next Month Begins)

Although your budget won’t change for months, it will be altered at some point due to your variable expenses. This is why I recommend that you create a new zero based budget every month just to be on track. You need to also do this before the next month begins to be ready and ahead of time.

Advantages And Disadvantages Of Zero-Based Budgeting

There are different budgeting methods, and they are all unique in a way; having their pros and cons.

Knowing the advantages and disadvantages of zero-based budgeting is an important step to take before you finally decide if you want to use the method or not. There are certain things you may like about it, while there are also a few factors that may not make it the perfect budgeting strategy for your financial situation.

[Pros]

- Helps You Account For Every Dollar

The most obvious benefit of using the zero based budget is being able to account for every dollar. It can be a little bit frustrating when you can’t tell how you spent your income by the end of the year. But when you budget to zero, you can easily give every dollar in your checking account a job.

You can certainly tell how much you spent on savings, housing, food, utilities, and what you reserve for miscellaneous. This makes you more accountable for your spending habits.

- Keeps You Aware Of Your Cash Flows

It’s funny how some folks don’t know exactly how much comes in and how much goes out. This budgeting strategy makes it very easy to determine your cash flow since you know the amount of money that goes in and out of your accounts.

Also, if you are trying to stop using credit cards, this method can get you back into a place of financial security.

- It Can Be Customized To Fit Your Needs

Another advantage of the zero based budget is being able to manage your income effectively even if you don’t really know how to handle money. You can customize the budget to fit your financial situation by adding or subtracting line-item needs each month. You can identify categories where you need to cut down on costs to save more or build an emergency fund.

- Helps You Identify Inflated Budgets

Sometimes, people make the mistake of having too much money in a specific line item in their budget. The zero-based budgeting method detects inflated categories. It helps you to look at the exact amount of money that should be put toward a line item in your budget. If after the whole setup, you have remaining cash, then maybe some budget categories need attention.

[Cons]

- Time-Consuming

If you are new to budgeting, this method may appear as though it takes a lot of time to manage. Since you are going to be accountable for your overall budget and monitor your spending every month, you have to always account for irregular costs. This is why the whole process may seem time-consuming.

Your attention is always needed to adjust the budget according to your needs each month. Besides, you should set money aside for extra costs by contributing more to your savings fund.

- Not Ideal For Variable Income

As a salary earner, you can always predict how much your income will be at the end of the month since your paycheck is fixed. But if all you have is a small business, it means your income is not fixed. You can’t specifically determine what your account balance would look like every month. Hence, you may have problems maintaining a zero based budget.

This method is easier for people who have a consistent cash flow.

- May Affect Your Long-Term Financial Goals

One of the downsides to using this budgeting strategy is that it could be detrimental to your long-term financial goals if you aren’t paying attention.

When you use the zero-based method, you are usually more concerned with your immediate expenses. As long as you can pay your fixed and variable expenses and then save some money, you feel everything is alright. But what happens if you want to purchase a car? This would require extra self-discipline to reserve extra cash for that financial goal in your zero-based budget.

- It Can Be Rigid

Although the zero-based budgeting method can be a little bit flexible, it can be rigid. Ideally, this method is supposed to prevent debt by stopping you from using credit cards. Since you are only using the money you earn every month, you don’t have any excuse to borrow money.

This is why it’s rigid. In a situation where you have to run out of cash in your budget, there could be problems. Although you may have an emergency fund, the financial challenge you are faced with could be more serious. This would compel you to take money from other categories to sort out the problem. This means something gets sacrificed eventually.

Quick Summary: Zero-Based Budget Method

If this is going to be your first time using the zero based budget, you must make sure that you have a realistic approach toward spending. If you are the type who overspends, it’s time to turn a new leaf. Aside from spending moderately, you need to understand your cash flow. Determine your total income each month so you know how to create the right financial plan.

Lastly, don’t forget to monitor your spending. That’s how you stay on track with your budget.

Pin this for later!